How to read a credit report

If you thought grades ended when you graduated from school, think again. As an adult, you still get graded on your use of credit, but instead of receiving an actual grade, you receive a credit score. Your credit report is easy to read once you understand its components.

Personal Information

Personal, identifying information is on your credit report. This includes all of the following information:

- Your legal name plus any previous names that you have used, including your maiden name, if applicable

- Social Security number

- Date of birth

- Current and previous addresses

- Current and previous phone numbers

- Current and previous employers

Credit history

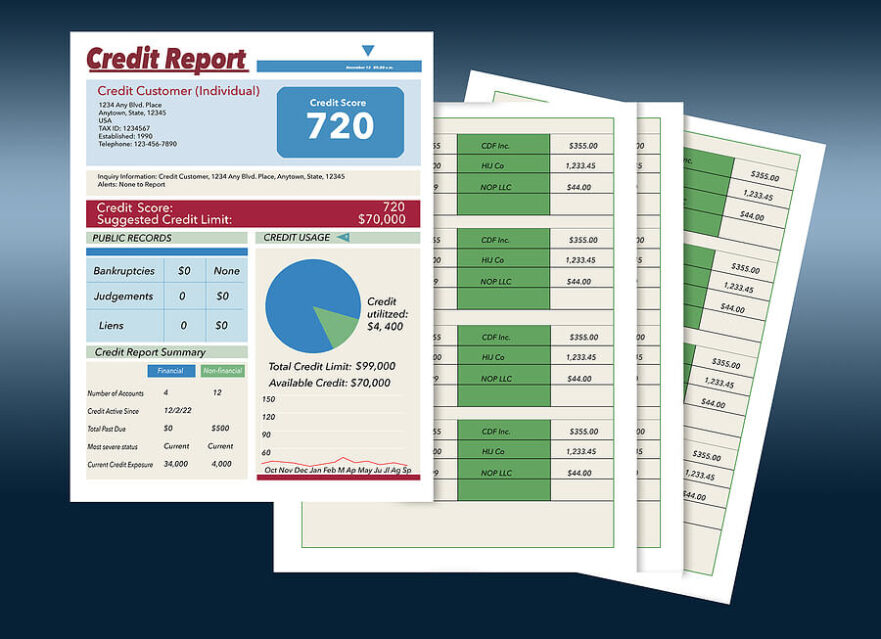

Your credit history is essentially a biography of your use of credit. It reflects how much debt you have acquired and how well you have done paying it off. This is shown through the following information:

- Open and closed accounts

- Date accounts were opened

- Credit limits and loan amounts

- Outstanding balances

- Payments and payment patterns

- Whether any co-signers or joint account holders share any of your debts

- Inquiries (a third party requesting your credit score)

Public record

Your public record information is also included on your credit report. This includes items like:

- Overdue child support payments

- Tax liens

- Bankruptcies

Your grade

When a third party makes an inquiry into your credit report, it does not usually receive the entire report. Instead, the credit bureau, who has compiled the data for your credit report, summarizes the information with a three-digit number, referred to as your credit score. Typically, the higher the number, the better the score, but each third party decides its acceptable range of scores for itself. This credit score tells the third party how likely you are to repay the debt.

Know your score

It is a good idea to keep on eye on your credit report. You are legally entitled to one free look at your credit report per year, and it does not adversely affect your credit score. This gives you a chance to have any mistakes corrected so that your credit score remains high